The greater availability of mortgage loans at higher loan to value (LTV) ratios has had a huge effect on the time it takes first-time buyers to save a deposit, according to Hamptons International’s Time to Save research, which is published today.

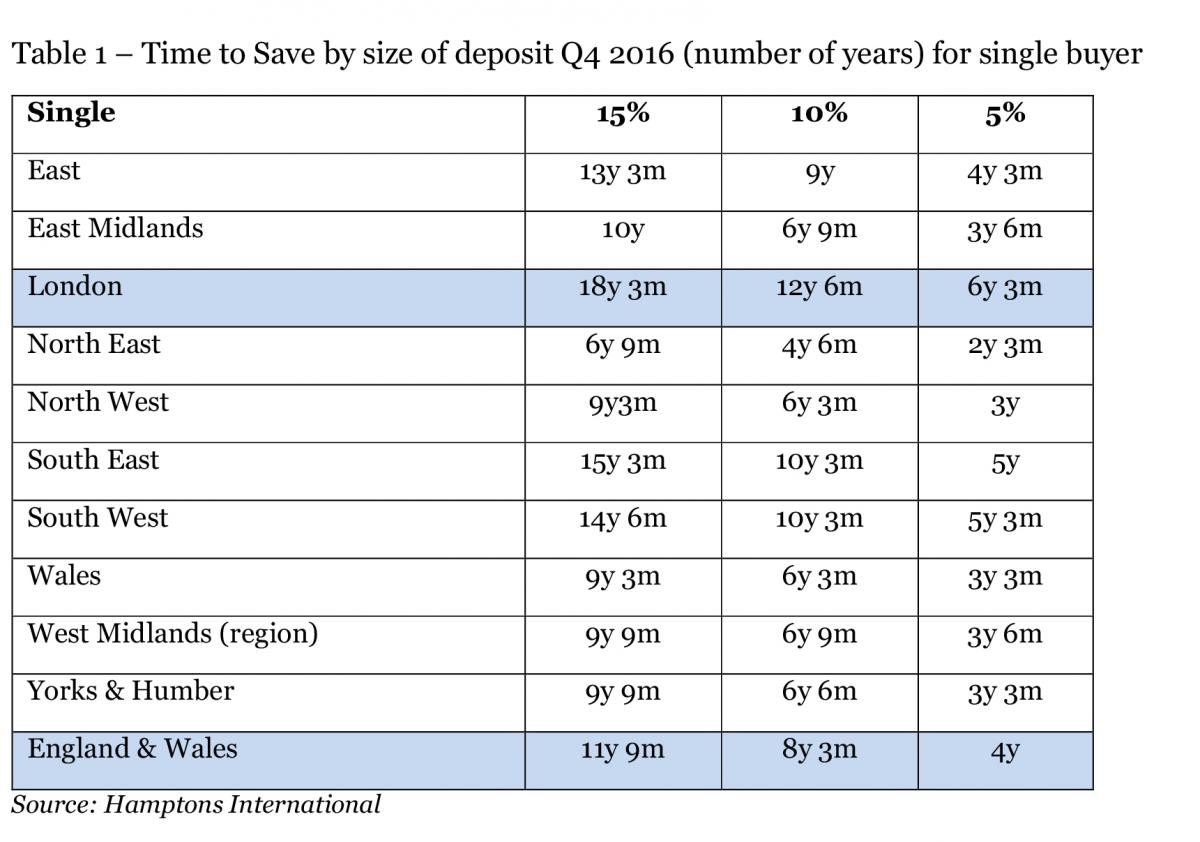

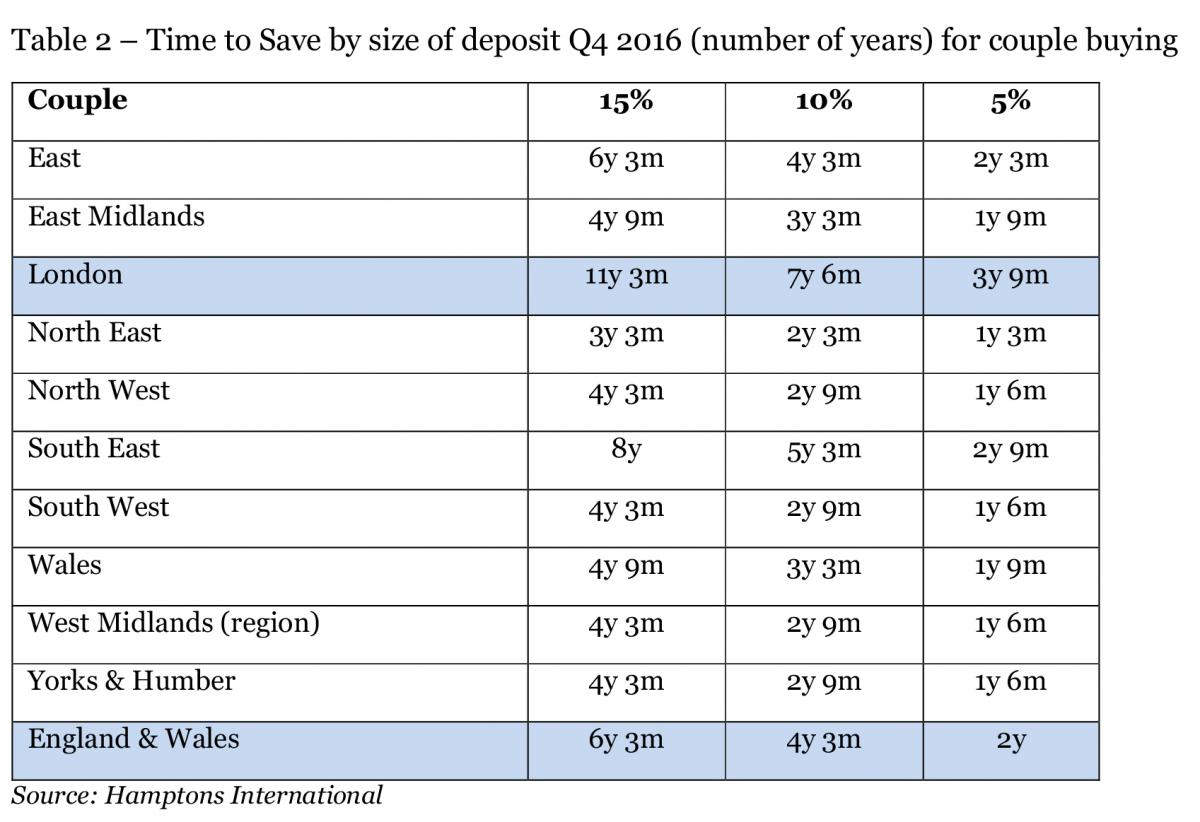

In Q4 2016 it would take an average single first-time buyer 11 years and nine months to save a 15% deposit. But reducing the deposit to 10% cuts three and a half years off the saving time to eight years and three months. Saving just 5% cuts seven years and nine months off the time to save a deposit meaning it takes just four years to save a deposit. (Table 1)

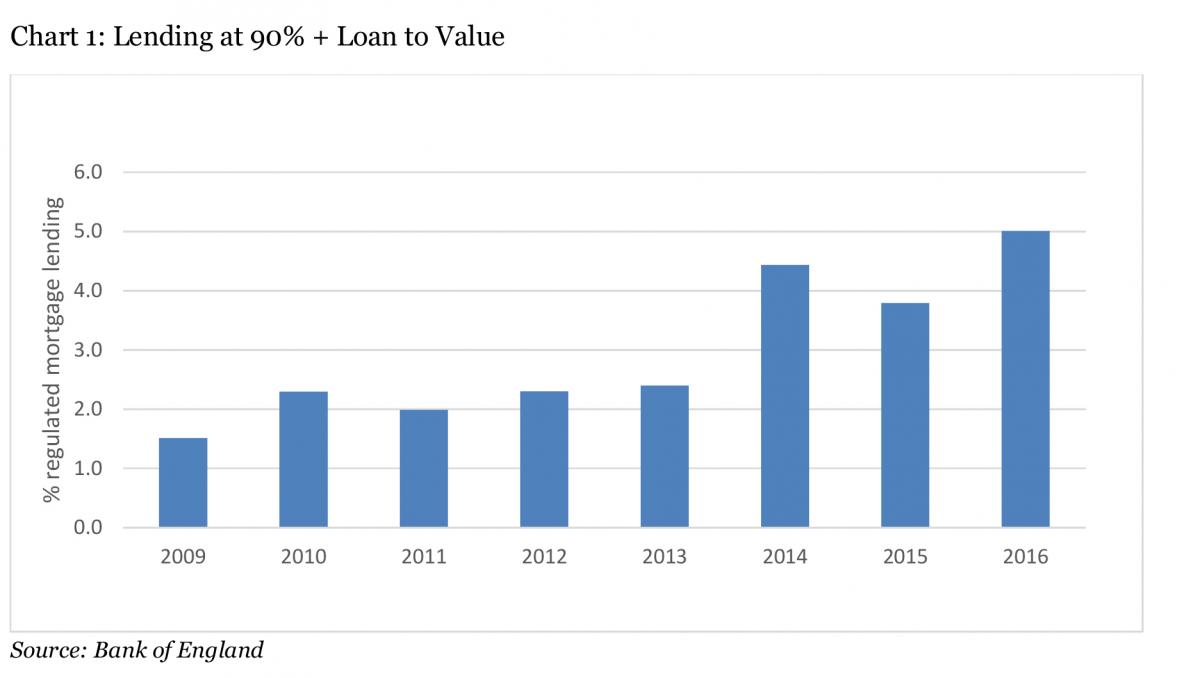

The proportion of loans made at 90% or more was 5% in 2016, up from 3.8% in 2015 and this increasing availability of lending at higher LTVs, combined with lower mortgage rates has improved the ability to buy for first time-buyers. (Chart 1)

The time to save for a deposit takes into account changes in incomes, house prices and most importantly the cost of spending on essentials. The analysis looks at both a couple and single person buying, is broken down by region, and by deposits of 5%, 10% and 15%. See notes to editors for methodology and assumptions made.

Time to Save Index key findings for 2016:

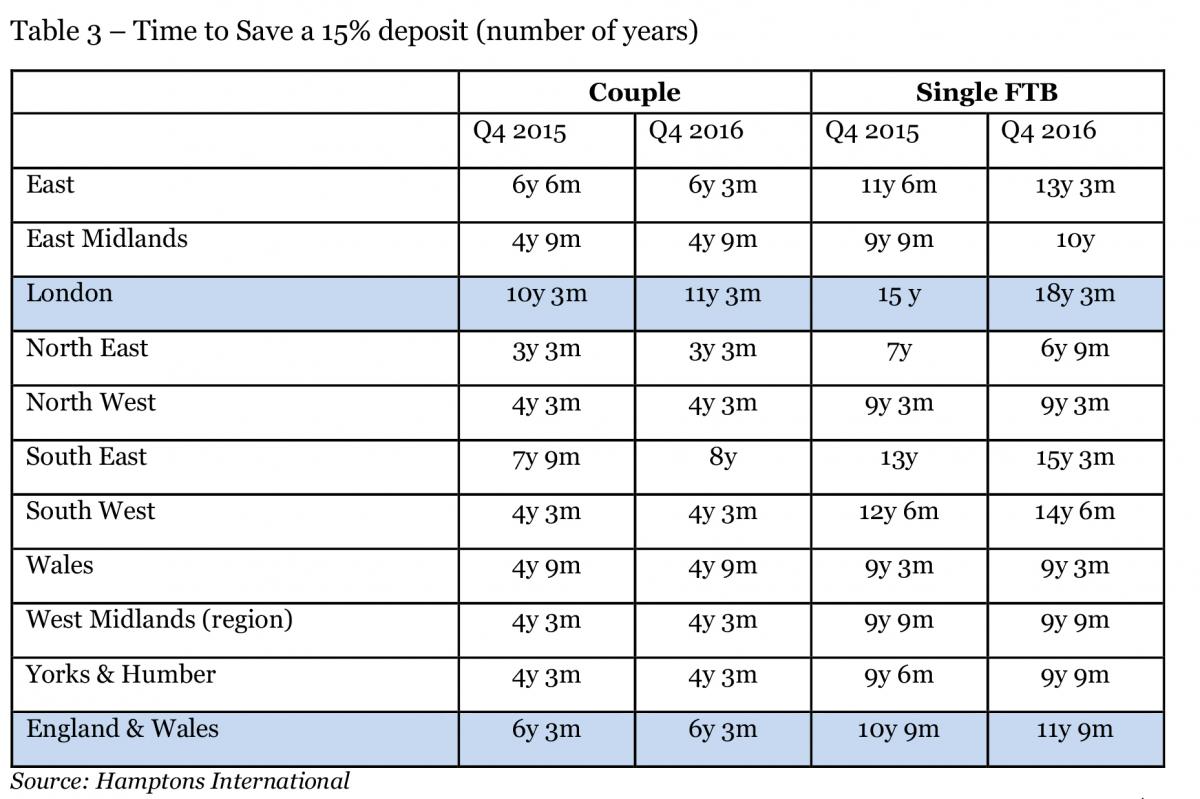

- The average length of time for a single first-time buyer to save a 15% deposit in Q4 2016 was 11 years and nine months, a whole year longer than in Q4 2015 as rising house prices outpaced the growth in incomes. (Table 3)

- The average time for a couple to save a 15% deposit in Q4 2016 was six years and three months, unchanged on Q4 2015. (Table 3)

- A single Londoner hoping to buy for the first time would need to save for 18 years and three months to raise a 15% deposit – up from 15 years at the end of 2015, while a couple would need 11 years and three months – a year longer than in Q4 2015. (Table 3)

- But the greater availability and lower cost of higher LTV mortgages make a big difference to the period a first-time buyer needs to save. Loans above 90% now account for more than three times the proportion of all loans than they did after the crash in 2009. (Chart 1).

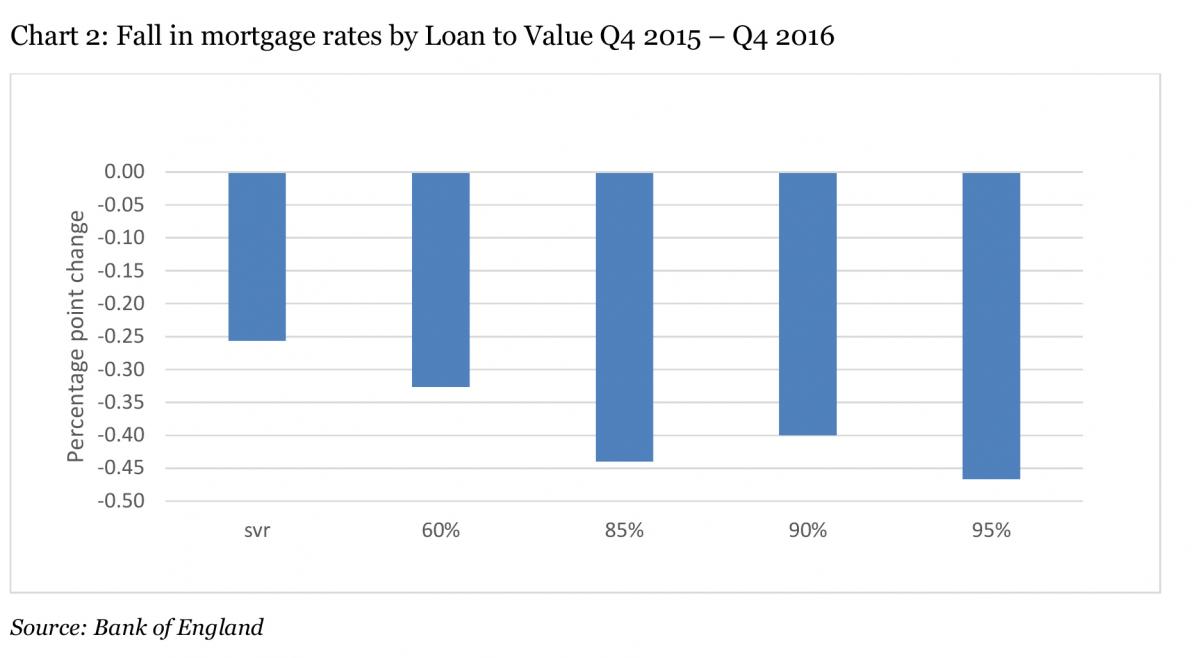

- Furthermore the cost of borrowing at over 95% has fallen by more than other types of loans. (Chart 2)

- Raising a 10% deposit rather than 15% cuts the time to save for single buyers by three years and six months to eight years and three months. Saving a 5% deposit cuts the time to save to just four years. (Table 1)

- In London saving a 10% deposit cuts nearly six years (five years, nine months)off the time it takes a single first-time buyer to save a 15% deposit. Raising just a 5% deposit rather than 15% cuts the time by 12 years to six years and three months. (Table 1)

Fionnuala Earley, Residential Research Director at Hamptons International said:

“It still takes an average single buyer nearly 12 years to save a 15% deposit for their first home. That’s a whole year longer than at the end of 2015. But it’s not all bad news. Lenders are increasingly offering higher loan to value mortgages and the rates charged on them have come down more than for any other mortgage type. Taking advantage of help to buy or taking out a 90% mortgage means that the time to save a deposit falls substantially. Rather than 12 years, a single buyer can save a deposit in just over eight. And if they use help to buy and save just a 5% deposit, they can save up in just four years.”

Full release with charts and methodology attached.

For further information please contact

Alison Blease

Press Office, Hamptons International

Tel: 0776 967 7825

Email: bleasea@hamptons-int.com

Fionnuala Earley

Residential Research Director, Hamptons International

Tel: 07760 163 120

Email: earleyf@hamptons-int.com

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Comments are closed on this article.